greenville county property tax estimator

Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 2500 Stonewall Street Suite 101 Greenville TX 75403.

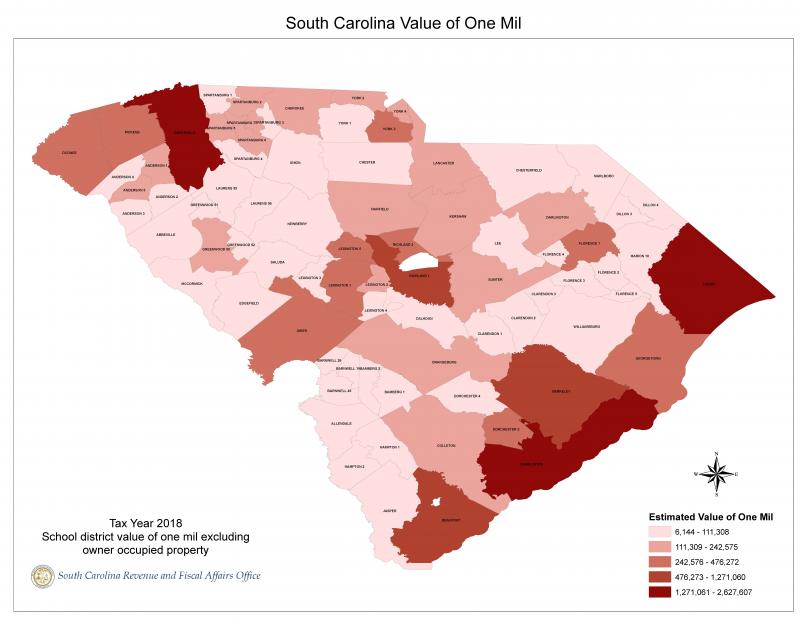

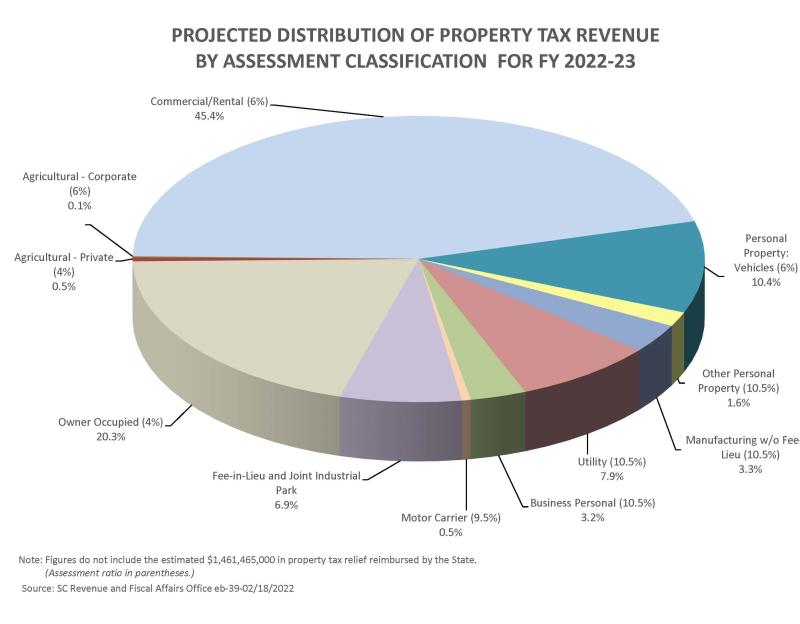

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value.

. The median property tax on a 14810000 house is 97746 in Greenville County. 903 408-4001 Chamber of Commerce Office 1114 Main St. Lexington County Coronavirus Covid19 Information.

The Greenville County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. For a list of tax authorities that levy taxes in each district please refer to the. Assessed Value X millage rate annual property taxes owed.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Estimated Range of Property Tax Fees. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. 005 - HORSE CREEK DUNKLIN FIRE 007 - SPEC ABATE CORRECTION COLL 008 - SPEC ABATE CORRECTION REF 015 - POSSUM KINGDOM S GVL FIRE 025 - COLUMBIA ANDERSON SCH-DUNKLIN 026 - POSSUM.

The median property tax on a 14810000 house is 74050 in South Carolina. Learn all about Greenville County real estate tax. Appraised Value X 06 Assessed Value.

Tax Estimator - Vehicle. Then multiply that number by the millage rate do a quick Google search for millage rates in Greenville for the district the property is in. The countys average effective rate is 069.

Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in. Tax Collector Suite 700. Taxes are payable at the Greenville County Tax Collectors Office Suite 700 County Square 8644677050 or by mail to address on notice.

Your county vehicle property tax due may be higher or lower depending on other factors. Tax amount varies by county. The assessors office can provide you with a copy of your propertys most recent appraisal on request.

For an estimation on county taxes please visit the Greenville county or Laurens county. And that will be your taxes for that property. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Search Vehicle Real Estate Other Taxes. VIN SCDOR Reference ID County File. GIS Property Mapping Data Services.

Log in or sign up to reply. According to county budget documents Greenville County expects to collect 9389 million in. The median property tax on a 13750000 house is 68750 in South Carolina.

The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. The median property tax on a 14810000 house is 97746 in Greenville County.

--Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050. SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties. Greenville County South Carolina.

Contact the Real Property Services Division at Greenville County Square Suite 1000 or call 8644677300 for the forms to appeal the assessed valuation of the property. The Greenville County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Greenville County. 864 467 7300 Phone 864 467 7440 Fax The Greenville County.

The median property tax on a 14810000 house is 155505 in the United States. Please make your check payable to Greenville County Tax Collector and mail to. Real estate and vehicle property taxes are collected by the county for schools and county services.

Please enter the following information to view an estimated property tax. County functions supported by GIS include real estate tax assessment law enforcementcrime analysis economic development voter registration planning and land development. The Greenville County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

What this means is that if the marketappraisal value of your property is 180000 the assessed value is 7200 if you live in the home as your primary residence and 10800 if you use the property as a rental or vacation home or something else. School 4 days ago Calculate. Only search using 1 of the boxes below.

The largest tax in. The median property tax on a 13750000 house is 144375 in the United States. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Pay TaxesPrint DMV Receipt. Search for Voided Property Cards. Real Property Tax Estimator - Greenville County.

The largest tax in. Greenwood County Tax Estimator South Carolina SC. Yearly median tax in Greenville County.

Contact your county tax. Please Enter Only NumbersTax District. The calculator should not be used to determine your actual tax bill.

South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

The median property tax on a 13750000 house is 68750 in South Carolina.

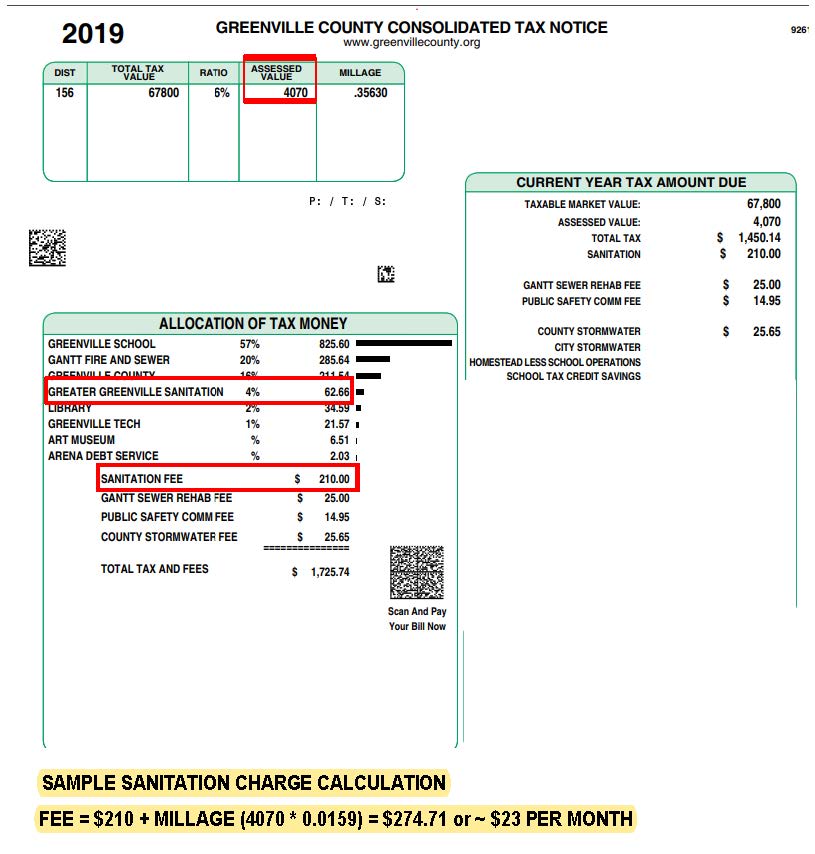

Fees Annexation Greater Greenville Sanitation

Cities Charging Road Maintenance Fees Face Scrutiny After Sc Supreme Court Greenville Ruling Greenville Politics Postandcourier Com

Carteret County Adopts Fy2020 21 Budget With 2 Cent Tax Increase News Carolinacoastonline Com

17 Pinckney Street Historic Hampton Pinckney District Of Greenville Sc Circa Old Houses

How To Calculate Property Tax And How To Estimate Property Taxes

1010 Boiling Springs Rd Greer Sc 29650 Realtor Com

Woodside Eleven Apartments Greenville Sc Apartments Com

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

New York Property Tax Calculator 2020 Empire Center For Public Policy

220 Windsong Dr Greenville Sc 29615 Realtor Com

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office